Executive Summary

BAFX is a regulated investment structure designed to give all investor classes institutional allocators, family offices, HNW/UHNW, and eligible retail, secure, governed access to two of the strongest long-term wealth engines: Bitcoin’s structural digital growth and the compounding income of institutional real-estate and infrastructure.

The Fund enables investors to participate in digital-asset upside while anchoring returns in tangible, cash-flow-producing assets inside a single, compliant, fully audited structure.

BAFX combines:

- Bitcoin & Bitcoin ETFs – a finite, globally adopted digital reserve asset with asymmetric long-term growth potential

- Institutional real assets – commercial property and infrastructure that deliver recurring income, NAV stabilisation, and liquidity support

This dual-engine model gives investors regulated exposure to Bitcoin while reducing volatility through predictable, cash-flow-driven assets. It is a structure built to grow, stabilize, and compound NAV over time.

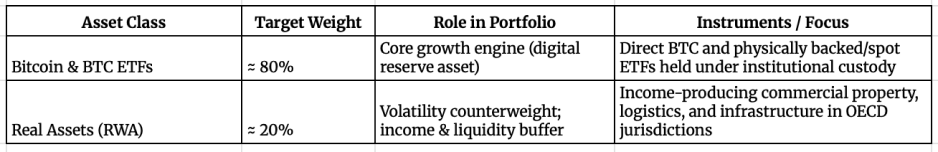

Approximately 80% of the portfolio is allocated to Bitcoin and Bitcoin ETFs, capturing long-term digital-asset expansion. The remaining 20% is invested in institutional-grade real estate and infrastructure across OECD jurisdictions, providing consistent income and strengthening liquidity during market cycles.

BAFX lowers traditional barriers to entry. Unlike private funds that require high minimum commitments, BAFX’s tokenised share model allows participation at smaller investment levels while maintaining full institutional standards of governance, custody, reporting, and audit.

Each BAFX Token represents a legally recognised share of the Fund, recorded on the official shareholder register and supported by independent custody and administration. Investors hold direct, regulated ownership, never synthetic exposure or unregulated exchange assets.

The Fund is managed by Boston & Alexander LLP, an FCA-authorised Alternative Investment Fund Manager (AIFM), and is domiciled in Bermuda as a Standard Fund under the Bermuda Monetary Authority (BMA). This dual-regulated foundation combines the oversight of a UK-regulated manager with Bermuda’s established digital-asset legal framework.

BAFX offers a modern investment approach: Bitcoin’s digital scarcity and real-estate compounding inside one regulated, accessible vehicle designed for long-term capital growth.

1.1 The Purpose of the Fund

BAFX was created to give investors regulated access to two of the most reliable long-term wealth drivers in global markets:

Bitcoin’s structural growth and the compounding income of institutional real estate and infrastructure.

While Bitcoin has matured into a recognised, globally adopted store of value, most investors still face limited, high-cost, or unregulated ways to participate. At the same time, income-producing real assets, commercial property, logistics, and essential infrastructure, remain proven engines of compounded returns, yet are typically accessible only through institutional-scale vehicles.

BAFX brings these two worlds together inside a single, governed investment structure.

The Fund enables investors to hold Bitcoin through a fully regulated, audited vehicle, while simultaneously benefiting from the stable, recurring income and long-term appreciation generated by real assets. This blend captures Bitcoin’s asymmetric upside while using tangible, cash-flowing assets to smooth volatility, reinforce liquidity, and compound NAV over time.

A key innovation is liquidity.

Traditional real-estate investments are inherently illiquid. BAFX solves this through a regulated, transactional fund structure that allows investors to subscribe, redeem (post-lock-up), and hold their shares via a digital format without ever being exposed to direct property illiquidity.

By applying institutional standards of custody, governance, and reporting, under the oversight of both the FCA (UK) and BMA (Bermuda), BAFX provides a secure, transparent pathway into Bitcoin and real-asset exposure for all investor classes, not just those capable of meeting high institutional minimums.

1.2 Why Investors Choose BAFL

BAFX gives investors a regulated, transparent, and transactional way to participate in two of the strongest long-term drivers of wealth:

(1) Bitcoin’s structural digital growth and

(2) the compounding income of institutional real assets.

Its framework is designed for all investor classes institutional, family office, HNW/UHNW, and eligible retail providing governed exposure without the limitations of traditional private funds or the risk profile of unregulated crypto platforms.

BAFX’s value proposition is built on four pillars:

1. Regulated Confidence (FCA + BMA)

BAFX operates under a dual-jurisdiction framework:

- FCA (UK) oversight through an authorised AIFM

- BMA (Bermuda) supervision as a Standard Fund

This ensures institutional-grade compliance, risk management, audit, and reporting aligning the Fund with established global governance standards.

2. Dual Growth Engine

BAFX blends two complementary return drivers:

• Bitcoin & Bitcoin ETFs

Capture long-term appreciation from a finite, globally adopted digital reserve asset.

• Institutional Real Estate & Infrastructure

Deliver recurring income, liquidity reinforcement, and NAV stabilisation, enabling returns to compound across cycles.

Together, these engines create a balanced portfolio designed to build, stabilise, and compound value over time.

3. Accessible Entry

Tokenised shares make the Fund transactional and accessible, lowering the entry threshold while preserving:

- regulated custody

- independent NAV administration

- institutional audit standards

- compliance oversight under FCA and BMA

This structure opens access to asset classes that typically require large institutional minimums.

4. Verified Ownership & Transparency

Each BAFX Token represents a legally recognised, redeemable share of the Fund:

- recorded in the official shareholder register

- synchronised with a regulated on-chain registry

- redeemable under the Fund’s liquidity terms

Independent administrators calculate NAV, verify holdings, and maintain full audit trails.

Summary

BAFX provides institutional-grade, regulated access to both digital and real-world asset growth.

Its hybrid structure is engineered to:

- build wealth

- compound value through income

- smooth volatility

- protect capital

- operate transactionally

- support both self-custody and custodian models

All within a governance framework grounded in established financial regulation.

2. Market Context & Fund Overview

Institutional adoption, regulation, and tokenisation are reshaping how investors access both digital and real assets.

Bitcoin has evolved from a niche technology into a globally recognised asset class held by institutions, sovereign entities, and corporate treasuries. In 2024, U.S. spot Bitcoin ETFs attracted over $3.3bn in Q1 net inflows (Reuters, 2024), marking the strongest institutional participation since inception. Yet, despite this growth, less than 5% of all Bitcoin sits inside regulated investment structures (Chainalysis, 2025).

The combination of Bitcoin and income-producing real assets directly addresses two of the biggest challenges in digital-asset investing: volatility and illiquidity. Bitcoin provides long-term structural upside, while real estate and infrastructure generate recurring cash flows that compound and stabilise NAV. By packaging these complementary return drivers into a single regulated, fully transactional fund structure, BAFX enables investors to participate in digital growth without sacrificing liquidity discipline or real-world income.

At the same time, institutional real estate and infrastructure continue to deliver stable, compounding income across market cycles, a characteristic historically unavailable to most investors due to high minimums, slow liquidity, and restricted access.

BAFX sits at the intersection of these two global trends.

It provides a regulated, transactional, and accessible way to gain exposure to Bitcoin’s long-term growth and the steady compounding characteristics of real assets — inside one governed structure.

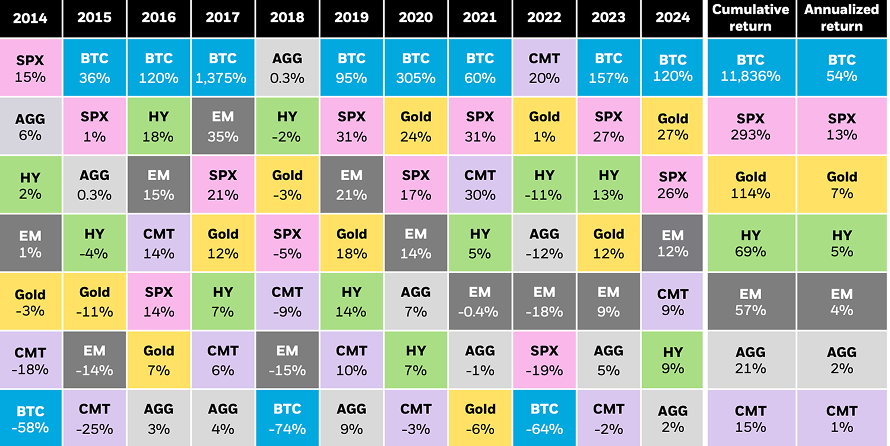

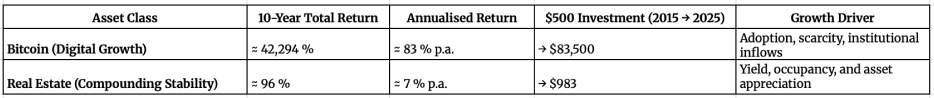

Exhibit 1 – Bitcoin’s high-growth potential paired with real-asset stability underpins BAFX’s dual-engine model.

Bitcoin has historically ranked among both the best- and worst-performing major assets, demonstrating high growth potential but significant volatility.

This illustrates the importance of a diversified structure like BAFX, which pairs Bitcoin with stabilising real-asset income.

Exhibit 1 – Bitcoin Performance vs Major Asset Classes (Source: iShares / BlackRock, 2024)

2.1. Market Tailwinds

Macro and Structural Drivers Shaping the Digital-Asset Market

- Institutional legitimisation: Approval of U.S. spot Bitcoin ETFs by leading issuers (e.g., BlackRock, Fidelity) confirms Bitcoin’s status as an institutional asset class (CoinDesk, 2024).

- Global adoption: 300m+ Bitcoin wallets exist worldwide, yet regulated access remains fragmented (Statista, 2025).

- Macro narrative: Concerns over inflation, currency debasement, and sovereign diversification strengthen Bitcoin’s role as “digital gold” (Forbes, 2024).

- Real-Asset Diversification: BAFL targets institutional-grade commercial and infrastructure assets across OECD markets to diversify geographic and sector exposure.

BAFL positions itself within this evolving landscape, combining Bitcoin’s long-term appreciation potential with the stabilising influence of income-producing real assets.

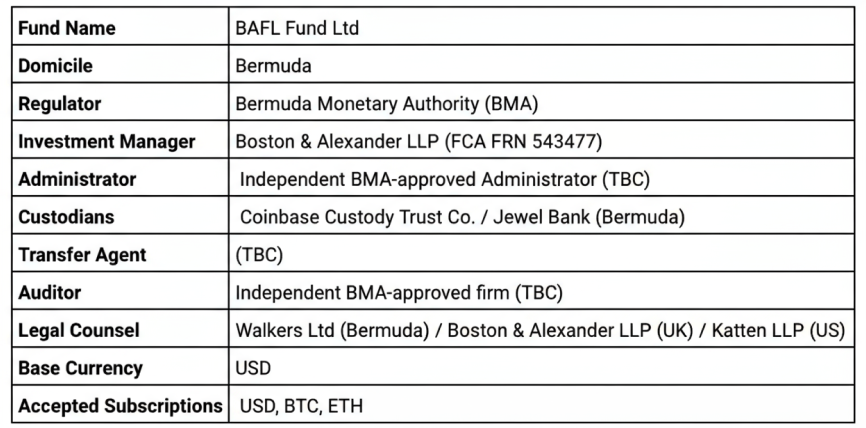

2.2 Fund Classification

2.3 Fund Classification

Registered as a Standard Fund under the Bermuda Investment Funds Act (2006) and compliant with the Digital Asset Issuance Act (2020).

Managed by an FCA-authorised AIFM under the Alternative Investment Fund Managers Regulations (2013), ensuring dual-jurisdiction oversight and investor protection.

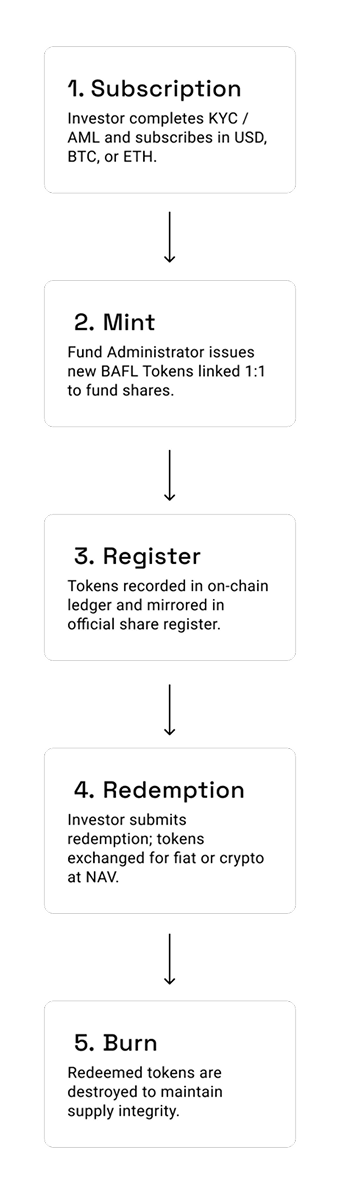

2.4 Tokenised Structure

BAFL Tokens represent participating, redeemable preference shares, recorded both on-chain and in the Fund’s official shareholder register.

Each token equals one legally recognised share, creating direct, auditable ownership.

Total Authorised Supply: 10,000,000 Tokens

Initial Issuance: 200,000 Tokens

Lock-Up Period: 12 months post-issuance

Redemption: Quarterly, subject to a 5% NAV gate

Custody: Self-custody or regulated custodians (Coinbase, Jewel Bank)

NAV Calculation: Monthly or quarterly by the Administrator

Reporting: Quarterly investor reports and annual audit under ISA standards

This structure ensures that every token is traceable, redeemable, and compliant under Bermuda and UK law, a true digital security representing regulated fund shares.

2.5 Key Features

- 1:1 Linkage between on-chain tokens and the official shareholder register.

- Multi-Signature Governance (3-of-5 control scheme).

- On-Chain Proof of Supply and real-asset valuations published quarterly.

Real-World Asset Exposure (RWA) Income-producing commercial property and infrastructure across OECD markets provide diversification and yield.

3. Investment Objective & Strategy

3.1 Objective

Deliver long-term capital growth through regulated Bitcoin exposure, managed with institutional controls. The Fund targets ≈80% allocation to Bitcoin and Bitcoin ETFs for growth, complemented by ≈20% allocation to income-producing real assets (real estate & infrastructure) to smooth volatility, support liquidity, and stabilise NAV.

3.2 Strategic Allocation

Allocations may adjust within defined risk limits as market conditions evolve, subject to Investment Committee oversight.

3.3 Investment Process

- Screening & Selection All holdings are evaluated for liquidity, regulation, custody, and counterparty quality.

- Risk Control Maximum 60% loan-to-value (LTV) at any subsidiary/SPV; no leverage at the master-fund level.

- Rebalancing Quarterly review to maintain target weighting and liquidity balance.

Valuation & Reporting Independent administrator responsible for NAV calculation, quarterly investor reports, and annual audits.

3.4 ESG Integration

BAFL applies Environmental, Social, and Governance principles across both Bitcoin and real-asset exposures:

Environmental

Preference for renewable-linked infrastructure and low-carbon initiatives.

Social

Excludes assets with adverse community or labour outcomes

Governance

Enforces independent audits, transparent valuations, and third-party verification

3.5 Summary

BAFL unites digital growth with real-world stability, offering investors exposure to Bitcoin’s long-term trajectory while reducing drawdowns through diversified, income-producing assets. The result is a balanced, risk-adjusted strategy managed within a fully regulated institutional framework.

Exhibit 4 Compounded Return Comparison: Bitcoin vs Real Estate (2015–2025)

Ten-Year Compounding Growth: Digital vs Tangible Assets

To illustrate BAFL’s dual focus on performance and stability, a 10-year comparative view highlights how Bitcoin and global real estate generate value differently, one through exponential price growth, the other through consistent compounding returns.

This combination is the foundation of BAFL’s balanced model, capturing Bitcoin’s long-term appreciation while maintaining steady income from real assets.

Illustrative 50/50 portfolio: $500 → $84,483 (≈ 55.8 % annualised return)

Source: BAFL Internal Analysis (2025), based on historical data for Bitcoin (2015–2025) and global real estate indices (MSCI, EPRA, CBRE). Illustrative only past performance is not indicative of future results.

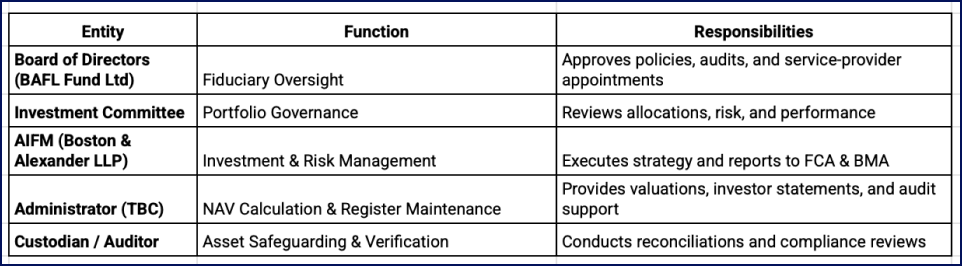

4. Governance & Regulatory Framework

BAFL operates under a dual-regulated structure combining the credibility of UK financial oversight with the flexibility of Bermuda’s digital-asset regime.

This approach provides institutional-grade governance while maintaining efficiency for digital-asset operations and cross-border investor access.

4.1 Oversight and Regulatory Bodies

Bermuda Monetary Authority (BMA)

The Fund is registered as a Standard Fund under the Investment Funds Act (2006) and operates in accordance with the Digital Asset Issuance Act (2020). The BMA supervises fund administration, audits, and investor protection, ensuring BAFL meets international standards for governance and reporting.

Boston & Alexander LLP (AIFM)

The Fund’s investment manager is an FCA-authorised Alternative Investment Fund Manager (FRN 543477). This provides institutional oversight in portfolio management, risk control, and investor reporting, aligning the Fund with established UK standards for transparency and fiduciary conduct. Investors’ confidence that the Fund adheres to recognised UK governance and transparency standards.

SEC Filing and Legal Opinion

BAFL’s U.S. eligibility is supported by a legal opinion from Katten LLP, confirming compliance with applicable SEC exemptions and cross-border participation rules. This opinion provides a foundation for future SEC filings and ensures the Fund’s structure aligns with U.S. regulatory expectations.

Registered Transfer Agent (TBC)

A SEC / FINRA-registered transfer agent (to be confirmed) will manage token issuance, investor onboarding (KYC / AML), and ownership verification. Its infrastructure links each digital token to the Fund’s official shareholder register, ensuring that every investor’s holdings are legally recognised and transparently recorded.

4.1 Oversight and Regulatory Bodies (Cont..)

Custody and banking arrangements are in final confirmation with the Fund’s regulatory and institutional partners.

The Fund will maintain segregated, insured accounts for all digital and fiat assets in accordance with both FCA and BMA standards.

Digital Asset Custody: Under review with tier-one BMA-approved custodians. Institutional cold storage, multi-signature structures, and insurance coverage under ISO 27001 standards will be implemented.

Fiat Banking: Final selection to be confirmed between UK and Bermuda jurisdictions, ensuring segregated client accounts and transparent cash reconciliation.

4.3 Custody & Banking (TBC)

Custody and banking arrangements are in final confirmation with the Fund’s regulatory and institutional partners.

The Fund will maintain segregated, insured accounts for all digital and fiat assets in accordance with both FCA and BMA standards.

Digital Asset Custody: Under review with tier-one BMA-approved custodians. Institutional cold storage, multi-signature structures, and insurance coverage under ISO 27001 standards will be implemented.

Fiat Banking: Final selection to be confirmed between UK and Bermuda jurisdictions, ensuring segregated client accounts and transparent cash reconciliation.

4.4 Investor Eligibility & Compliance

- U.S. Investors: Reg D 506(c) / Reg S – Accredited and Qualified Purchasers

- Non-U.S. Investors: Qualified under the Bermuda Digital Asset Issuance Act (DAIA) framework

- Retail Investors: Permitted post 12-month lock-up in eligible jurisdictions

KYC / AML: Conducted through the Fund’s administrator and reviewed annually under BMA and FCA compliance requirement

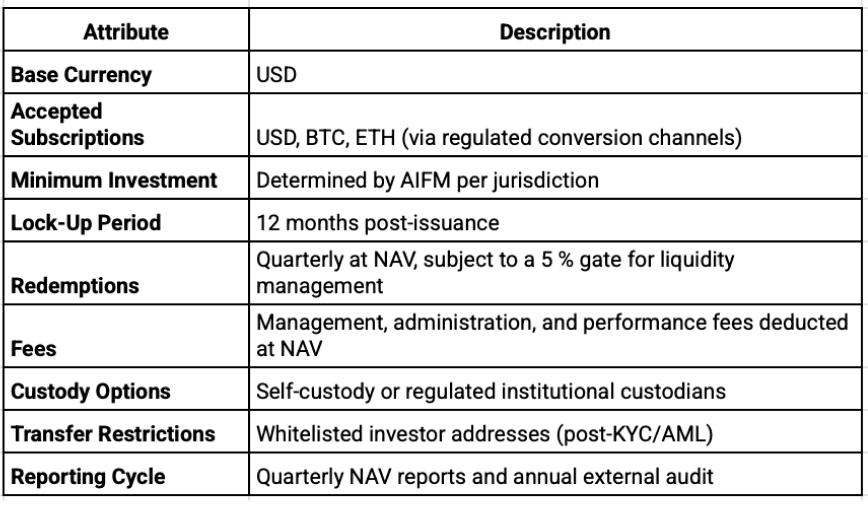

5. Investor Proposition & Terms

BAFL provides investors with a transparent and regulated route to gain exposure to Bitcoin through a tokenised share structure, managed with institutional discipline and independent oversight.

5.1 Investor Eligibility

Participation in the Fund is open to:

- Qualified and Accredited Investors under U.S. Regulation D (Rule 506(c)) and Regulation S exemptions.

- Non-U.S. Investors meeting the criteria of the Bermuda Digital Asset Issuance Act (DAIA).

- Eligible Retail Investors in select jurisdictions, subject to compliance review and lock-up provisions.

All participants must complete KYC / AML verification via the Fund’s approved transfer-agent platform prior to subscription.

5.2 Subscription & Liquidity Terms

- Base Currency: USD

- Accepted Subscriptions: USD, BTC, and ETH (converted through regulated channels)

- Initial Lock-Up Period: 12 months post-issuance

- Redemptions: Processed quarterly at Net Asset Value (NAV), subject to a 5 % redemption gate to preserve liquidity discipline

- Reporting Frequency: NAV calculations monthly or quarterly; audited annual statements

These terms balance accessibility for investors with prudent liquidity management and fund-level stability.

The structure ensures full transparency and investor control while maintaining institutional-grade compliance and segregation of assets.

5.3 Transparency & Verification

Each BAFL Token represents a legally recognised share of the Fund and is recorded both:

- On-chain, via a regulated transfer-agent framework, and

- Off-chain, within the official shareholder register maintained under Bermuda law.

This dual-record system ensures that investor ownership is verifiable, transferable, and fully compliant with applicable securities regulation.

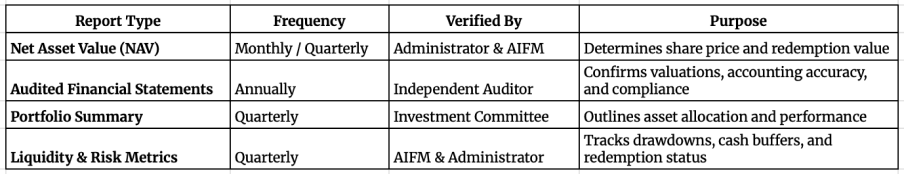

6. Transparency & Reporting

Transparency is central to BAFL’s governance philosophy.

Every stage of the Fund’s operation, from valuation and custody to token issuance, is independently verified under recognised financial standards.

By combining on-chain verification with institutional oversight, BAFL provides investors with visibility, accountability, and trust.

6.1 Reporting Schedule

BAFL’s reporting follows the same structure as a traditional alternative investment fund, enhanced by digital transparency:

6.2 Digital Record-Keeping

Each investor’s holdings are recorded in two synchronised registers:

- the official shareholder register maintained in Bermuda, and

- A secure digital register managed by the Fund’s appointed administrator.

This ensures that:

- All issued and redeemed shares are traceable in real time.

- Ownership records match the legally recognised register.

- Transaction history can be verified by investors and regulators through approved fund channels.

This dual-record model provides transparency while maintaining full compliance with securities regulations

6.3 Independent Audit & Oversight

- Administrator (TBC): Calculates NAV, reconciles subscriptions/redemptions, and maintains registers.

- Auditor: Performs annual audits under ISA standards.

- AIFM / Compliance Officer: Oversees risk management, reporting, and dual-jurisdiction compliance under the FCA and BMA.

These independent layers establish a continuous audit trail connecting portfolio valuation, fund accounting, and investor ownership.

6.4 Investor Access

Investors receive secure digital access to:

- Portfolio allocation and NAV performance

- Audited financial statements and quarterly reports

- Governance, compliance, and fund-policy documents

All reports remain accessible through the Fund’s investor portal and are available for regulatory review.

BAFL’s transparency framework aligns with and in several areas exceeds traditional fund reporting standards, enabling investors to confirm what they own, how it performs, and how it is governed.

BAFL’s reporting model merges on-chain verification with institutional auditing.

6.5 On-Chain Proof

BAFL will deploy on a secure, scalable blockchain network to be confirmed following cost-efficiency and security assessment.Shareholder register synchronised with administrator database.

Real-asset valuations audited semi-annually by RICS-certified valuers.

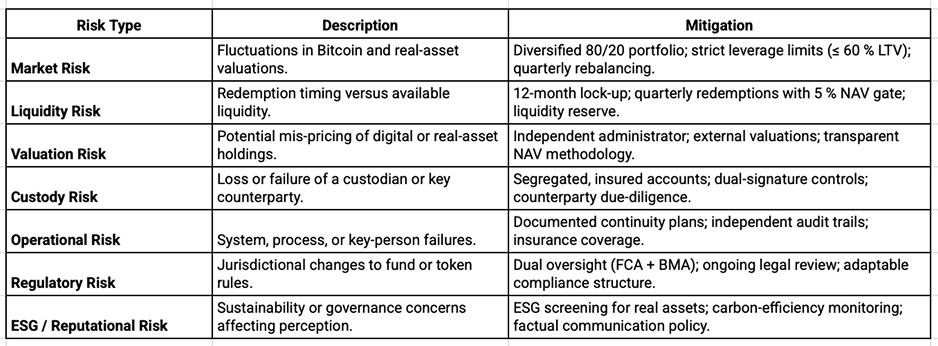

7. Risk Factors & Controls

All investments carry risk.

BAFL manages these risks through the same governance, valuation, and oversight standards applied to institutional alternative funds, enhanced by real-time monitoring and dual-jurisdiction regulation

7.1 Risk Management Framework

Risk oversight is embedded within the Fund’s AIFM and BMA compliance structures. Each category of risk is identified, assessed, and monitored through defined policies and independent reporting…

7.2 Oversight and Reporting

- AIFM Risk Officer monitors exposure limits and produces quarterly risk reports.

- Administrator & Auditor verify NAV, leverage ratios, and valuation assumptions.

- The Compliance Officer reviews AML/ATF procedures and reports findings to the FCA and BMA.

- The Board of Directors receives consolidated risk summaries every quarter.

7.4 Summary

BAFL maintains business-continuity and disaster-recovery plans consistent with the FCA’s Operational Resilience Policy (PS21/3).

Critical data is securely stored across multiple jurisdictions, and all third-party service providers are subject to due-diligence and renewal reviews.

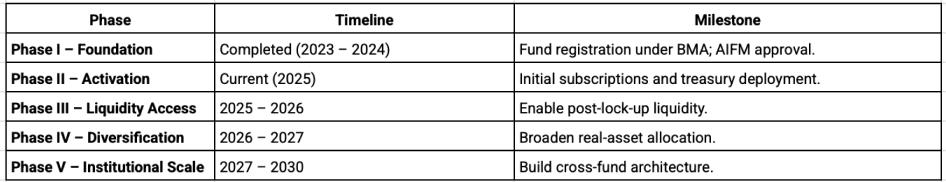

8. Roadmap & Future Outlook

BAFL’s roadmap focuses on three measurable priorities:

1 – Operational scalability

2 – Regulated liquidity access

3 – Expansion of real-asset exposure

These objectives are anchored in compliance, not speculation, each phase advances only when underlying governance and partnerships are confirmed.

8.1 Development Phases

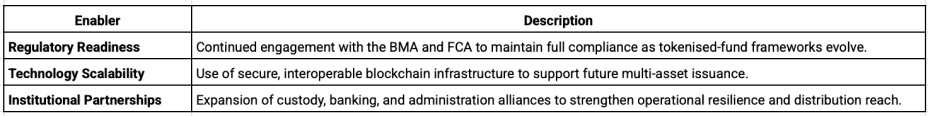

8.2 Strategic Enablers

8.3 Long-Term Positioning

BAFL’s long-term vision is to become a benchmark regulated digital-asset fund. bridging Bitcoin’s growth potential with the stability of real-world assets.

The Fund’s structure enables future replication for thematic strategies such as infrastructure, renewables, and digital-yield vehicles.

By staying aligned with financial regulation and technological innovation, BAFL aims to set a new standard for how regulated capital participates in the digital economy.